Key Investment Principles

Diversification

Diversification is the main investment technique used to reduce investment risk.

A common description of the importance of diversification is "Don't put all of your eggs in one basket".

This ethos explains the importance of diversification when it comes to investing as it highlights the risk of having all of your wealth invested in just one asset class.

If you had all of your eggs in one basket, and if you dropped that basket unfortunately all of your eggs will break. By placing each egg in a different basket there is a higher chance of losing one egg, but less risk of losing all of them.

When it comes to investing, having all of your wealth invested within just one asset class would be considered risky. This investment approach is risky as it is not unusual for a single asset class to fall a significant amount. It is much less uncommon, for all asset classes to fall at the same time. By investing in just one asset class, and in the event that asset class falls you will lose a large portion of your wealth.

While risk is reduced by implementing diversification, so too is the potential returns. By diversifying, an investor loses the chance of maximising their returns as their exposure to the best performing asset is less. BUT, the investor also avoids having invested solely in the asset that comes out worst. Thus is the role of diversification.

Diversification need not either help or hurt returns, it merely narrows the range of possible outcomes thus reduces risk.

Diversification strives to smooth out the performance of an investment portfolio by reducing the negative performance of some investments with that of the positive performance of others.

The Risk of Diversification

The best expression that explains the dangers of diversification comes from one of the greatest investment thinkers of all time, John Maynard Keynes, who wrote in 1934:

“As times goes on, I get more and more convinced that the right method of investment is to put large sums into assets which one thinks one knows something about. It is a mistake to think one limit’s one’s risk by spreading too much between asset classes about which one knows little and has no reason for special confidence.” Maynard Keynes

The insights provided by Keynes is supported by many successful investors including Warren Buffett:

“Wide diversification is only required when investors do not understand what they are doing. Diversification is a protection against ignorance. It makes very little sense for those who know what they’re doing.” Warren Buffett

If diversification reduces risk at the cost of returns is there an alternative?

The Opposite to Diversification – Portfolio Concentration

"Diversification preserves wealth, concentration builds wealth." Warren Buffett

While diversification can be defined as “Don’t put all your eggs in one basket” another common statement is “Nothing ventured, nothing gained”. The aim of all prudent investing is to find the right balance between these two adages.

Whilst a concentrated portfolio offers higher potential returns, the investor must be aware of the higher risk associated.

While both Buffett and Keynes argue the benefits of adopting a concentrated investment portfolio when it comes to maximising returns both highlight the need to have an in-depth knowledge about the asset class you have a large portion of your wealth.

The investor who adopts a highly concentrated portfolio for short term thrill usually suffers financially over the long term, or will they? This board game is designed to teach you that lesson.

Compound Interest

Albeit Einstein described compound interest as the eighth wonder of the world.

The most important trait to create wealth is that of TIME. Investors usually learn the hard way through the school of hard knocks that creating wealth takes patience. When most investors realise the importance of taking a long term view it is way too late for them to create financial freedom.

Most people underestimate what can be achieved over the long term, but overestimate what can be achieved in the short term. There is no better example of this than when it comes to investing.

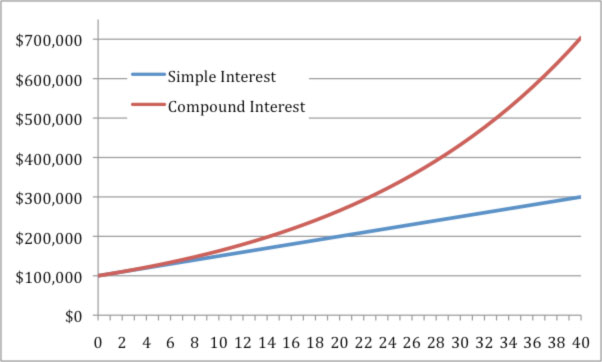

Simple Interest v Compound Interest

Simple interest is interest earned over a period on an initial investment amount. 5% simple interest on a $100,000 investment is $5,000 per year.

Compound interest is in simple terms interest on interest. That is, your return should ‘compound’ as time passes as the return from your investment increases at a growing rate. This occurs as you enjoy the return not just on the initial investment but also on returns achieved during previous periods. Compound interest can therefore significantly boost investment returns over the long term.

Example

A $100,000 investment that receives 5% simple interest would earn $200,000 in interest over 40 years. Compound interest of 5% on $100,000 would amount to $603,999 over the same period. A very big difference as depicted in the chart below.

The investor has earned $403,999 in interest due to the benefits of compounding.

Different types of investments

There are five main types of asset classes available to invest in. Each asset class has different risk and return profiles. Within this game each player is limited to these five main asset classes. The table below highlights the characteristics of each asset class.

| Asset class |

Characteristics | Income potential | Capital Growth Potential | Risk | Potential return | |

|---|---|---|---|---|---|---|

| Defensive assets (focus on capital preservation) |

Cash includes bank deposits, savings and cheque accounts |

Suitable for investors who have a short term outlook, a low tolerance to risk, or if market volatility is high. Provides a stable and low risk income, usually equally in the form of regular interest payments. No recommended minimum timeframe. |

Low | Low | ||

| Fixed Interest includes government bonds, corporate bonds, and hybrid securities |

Can be more volatile than cash, but are still relatively stable. Income return is usually in the form of regular interest payments for an agreed period of time. Minimum suggested time frame: 1–3 years |

Low | Moderate | |||

| Growth Assets (focus on capital growth and income) |

Property Includes direct residential, industrial and commercial property |

Has a higher risk than fixed interest but less risk than shares. Less liquid than other asset classes resulting in a higher recommended minimum timeframe. Entry and exit costs significantly higher. Minimum suggested timeframe: 7+ years |

High | High | ||

| Domestic Shares | Domestic shares involves owning part of a company. As a part owner share holders share in the profits and future growth. Returns are derived from capital growth and income through what is called dividends. Shares are the most volatile asset class but over long periods of time, on average, has achieved high returns. Minimum suggested timeframe: 5–7 years |

High | High | |||

| International Shares | Like Domestic Shares, International Shares derive their returns from capital growth and dividends. Like domestic shares this asset class is volatile but over long periods of time, on average, has achieved high returns. In addition to the risks associated with domestic shares, currency fluctuations can also affect performance of International Shares. Minimum suggested timeframe: 5–7 years |

High | High |

Leverage

Leverage involves borrowing money from the bank to invest. By having more money invested the returns can be much higher when the asset appreciates in value, however losses are also magnified when the asset value falls in value.

Leverage has been a great tool available to investors to accelerate their wealth, although many investors have lost their entire wealth through the use of leverage.

If you elect to borrow funds to invest within the game of Diversification you can only borrow up to a maximum of the same amount as your Total Net Worth.

Example – If you have $10,000 in Total Net Worth, you can borrow up to $10,000 in additional funds. If you borrow the maximum amount the player has a total of $20,000 to invest for the year.

When an investor borrows money for investment purposes the banks charge an interest expense. The interest expense is based on a percentage of the borrowed amount.

The borrowing costs or what is called the interest expense is fixed at 7% per annum within the game of Diversification.

Example – If you borrow $10,000 as in the example above, your interest expense for one year will be $700.

For the game of Diversification this interest expense is paid yearly in arrears and is subtracted from the gains (if any) or added to the losses.

Example

A players Total Net Worth is $5,000 and the player has Savings of $5,000 for the year. This gives the player $10,000 in Total Funds Available for Investing.

The player wishes to borrow from the bank the maximum amount. The player can therefore borrow another $10,000 giving them a Total Investment Amount of $20,000.

Let's assume the player invests 100% of this amount into Property.

If the return is 10% for Property that year, the player makes a Return ($) of $2,000 (10% of $20,000).

The Interest Expense is $700 (7% of the borrowed amount being $10,000).

The total net return is $1,300.

As the player only outlaid $10,000, the net return is actually 13% ($1,300 of $10,000) rather than 10% being what the underlying asset increased in value.

If the property fell in value by 10%, the player would lose $2,000 (10% of $20,000) plus the interest expense being $700 (7% of the borrowed amount). The total loss would therefore be $2,700 ($2,000 + $700) or 27% of the players Net Worth.

As can be seen by the above example, leverage is often described as a double edged sword. It can magnify both returns and losses significantly.

To mitigate the high risks associated with leverage, players can reduce the leverage amount or not borrow to invest at all.